What are The Advantages of Using a Crypto Payment Provider Instead of a Traditional Bank?

Just a few days ago, Bitcoin crossed the $88k mark and is set to reach $90k before the weekend. Following Trump’s re-election, more people are investing in cryptocurrencies. However, do you know that you can actually spend Bitcoin as a medium of exchange? To further enlighten you, this article will share why using a crypto payment provider is better than traditional banks.

Cryptocurrency as a Medium of Payment

Most people still see cryptocurrencies like Bitcoin strictly as investments, which explains why they focus on buying and HODLing. For those who do not understand, HODL means – “hold on for dear life” in the crypto world, which implies purchasing blockchain tokens as long-term investments.

This is not to say that cryptocurrencies are not a good form of investment. However, many people still don’t see cryptocurrencies for what they are – currencies (medium of exchange and store of value). We even covered this in a recent article, discussing if Bitcoin is real money.

Satoshi Nakamoto created Bitcoin (the world’s first cryptocurrency) in response to the 2008 financial crisis. This new kind of money aims to offer a decentralized and more reliable financial system. What are financial systems for? Exchanging funds. Or, in simpler terms, paying for goods and services.

There are several ways to use crypto as a payment solution. Some of these include the following:

- Direct Wallet Transfer: This involves sending and receiving tokens through a blockchain wallet via their respective network. Individuals have to pay gas or transfer fees, depending on the blockchain.

- Crypto Merchants and Off-Ramps: These individuals or organizations trade fiat tokens for cryptocurrencies and vice versa. Users pay commissions to merchants, in addition to the fees paid during the token transfer.

- Crypto Payment Provider: In this case, companies create layer-2 solutions that enable a more efficient transfer of blockchain tokens. The fees are typically lower than direct wallet transfers.

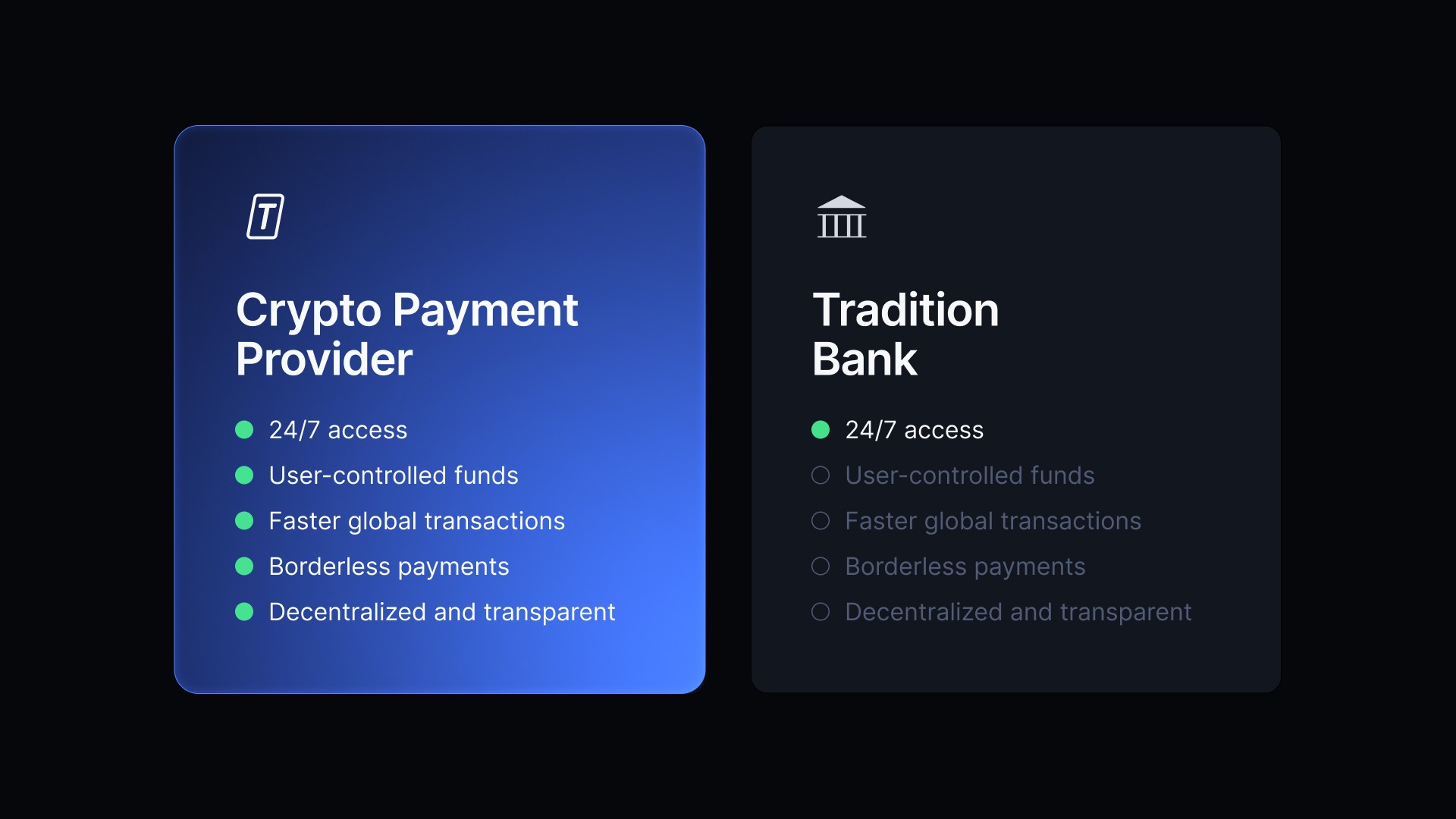

What are the Advantages of a Crypto Payment Provider Over Banks?

A crypto payment provider is quite similar to your regular bank. They enable people to send and receive money while lowering the exposure to risks.

Despite their similarities, cryptocurrency payment service operators are far superior to traditional banks. To buttress this point, here are some advantages of using a crypto payment provider:

- User-Controlled Funds: The average person will argue that they control their money until you ask them to withdraw $1 million from their bank account. With a crypto payment provider, people remain 100% in charge of their money. They can do just about anything, they want, at any point in time.

- Faster Global Transactions: Most international transactions take several working days when sending money via bank. Even the “fastest” options have a waiting period between 1–3 days. Cryptocurrencies, on the other hand, process transactions within minutes.

- Borderless Payments: This is self-explanatory, especially when you look at the “sanctions” placed on specific countries. Good luck sending money to your loved ones living in specific regions. With a very good crypto payment provider like SoftNote, you can send funds to just about anyone globally.

- Decentralized and Transparent: Since crypto payment providers build their products and services on blockchain, everyone is transparent and decentralized. Anyone can access the Block Explorer to monitor all transactions. This is a far more efficient fraud-prevention method. However, this discussion is for another day.

SoftNote – The Best Crypto Payment Provider

Before jumping on any cryptocurrency payment solution, you should know that they are not all the same. In fact, certain crypto payment gateways are superior to others. SoftNote, the faster Bitcoin payment gateway from Tectum, is the best crypto solution.

Here are some reasons why you should choose SoftNote:

- Cheapest Fees for Microtransactions: With SoftNote, users pay 0.5% fees of the value they send in commission. However, there is a catch. Regardless of the amount sent, the transfer fee will never exceed $1.

- Instant Transactions: Water is wet, Americans must pay taxes, we will all die one day, and SoftNote transactions take effect instantly.

- Vast Network of Merchant Partners: From Australia to Africa, Tectum is increasing the number of merchant partners who accept cryptocurrency through SoftNote Bills. These are local businesses looking to accept Bitcoin and other cryptos. Tectum partners will them to enable people to spend their directly and for cheap. No conversion is necessary.

What are you waiting for? Join the best crypto payment provider by creating a SoftNote account today.