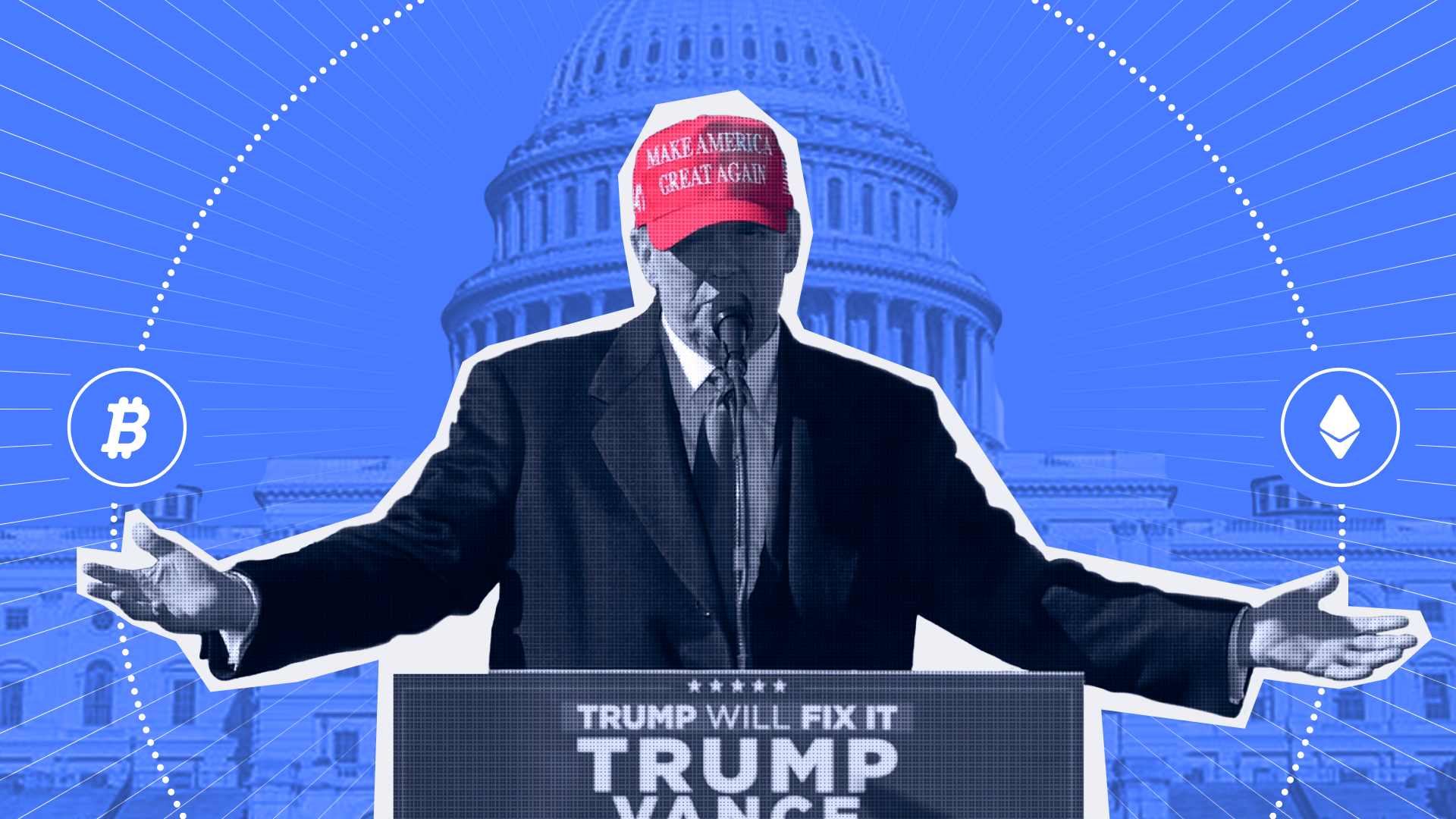

US Elections 2024 – Trump Secures a Historical Return to the White House

Trump’s Victory in US Elections Paves the Way for U.S. Cryptocurrency Expansion

Trump’s Victory in US Elections Paves the Way for U.S. Cryptocurrency Expansion

Donald Trump’s historic 2024 election win may bring sweeping changes to U.S. cryptocurrency policy. Alongside the promise of bringing economic and immigration policies, his campaign proposed a “Bitcoin reserve,” suggesting the U.S. government acquire up to 1 million bitcoins over five years, bolstering national reserves and tackling debt reduction through crypto assets, as reported by Wired.com.

Trump’s support for appointing crypto-friendly regulators signals an intention to simplify cryptocurrency regulation, potentially making the U.S. a global crypto hub. This policy shift could drive Bitcoin and blockchain innovations, attract international investors, and potentially challengeing the UAE for its spot as the “crypto capital”.

As part of his pro-crypto stance, Trump proposed creating a favourable regulatory environment for blockchain companies in an attempt to attract investors and create the US crypto off the scratch industry. One of Trump’s well-known strategies is the appointment of qualified and business-narrow advisors as he practiced during his first tenure in 2016-2020. Therefore, in his second tenure, he may rely on the previous strategy while appointing advisors with pro-crypto views to agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This change to the current administration could foster greater confidence among businesses and investors alike, potentially leading to the establishment of new blockchain companies and expanded use of digital currencies like Bitcoin and Ethereum within the U.S.

During his campaign, he argued that cryptocurrencies, especially Bitcoin, offer an opportunity to hedge against inflation and diversify the national reserve. This approach resonates with many U.S. investors and citizens who view cryptocurrency as a pathway to financial independence and stability, especially given recent economic challenges.

Critics, however, caution that Trump’s policies may face hurdles. A “Bitcoin reserve” would represent an unprecedented move for the U.S. financial system, requiring significant buy-in from Congress and financial oversight bodies of the unknown to some equity. Additionally, some financial analysts worry that too strong a focus on cryptocurrency could introduce volatility into national finances. Nonetheless, the administration remains optimistic, seeing crypto as an opportunity for economic growth and debt reduction, including the potential leverage of the House and Senate which now are Republican.

Another appealing aspect of introducing cryptocurrency on the US national level is the potential for tax benefits related to crypto trading and holdings. His team has previously suggested that incentivising crypto investments through “tax breaks” could encourage more U.S. citizens to participate in the digital economy, rather than relying on cash. This could drive a surge in crypto adoption across various industries, such as real estate, finance, and retail, where blockchain applications are already gaining traction.

Trump’s victory may bring a new chapter for U.S. crypto policy, aiming to establish the nation as a leader in digital finance. If successful, this direction could solidify the U.S. as a global crypto powerhouse, providing a regulated, innovation-friendly environment that could shape the future of global cryptocurrency markets.