What is Off-Chain and On-Chain?

On-chain transactions are processed and recorded directly on the blockchain. Writing data to the blockchain requires a consensus mechanism to verify the transaction. This verification process ensures that on-chain transactions are secure, transparent, and immutable. On-chain transactions typically take longer and cost more than off-chain transactions due to the consensus mechanism required for verification.

On the other hand, off-chain transactions are processed outside the blockchain. They move assets or information between two parties without writing to the blockchain. This enables faster and cheaper transactions, which don’t require consensus verification. Off-chain transactions generally offer less security than on-chain transactions but can become more secure with various security measures.

| Attribute | On-chain Transactions | Off-chain Transactions |

|---|

| Processing Location | Directly on the blockchain | Outside the blockchain |

| Consensus Mechanism | Required for transaction verification | Not required |

| Verification Process | Ensures security, transparency, and immutability | None by default, but can be enhanced with measures |

| Transaction Speed | Typically slower | Faster |

| Transaction Cost | Generally higher due to consensus mechanism | Cheaper |

| Security | High | Lower, but can be improved with security measures |

Is Coinbase On-Chain or Off-Chain?

Coinbase is primarily an on-chain platform, as all transactions are recorded on the Ethereum or Bitcoin blockchain. However, Coinbase also offers off-chain solutions like Coinbase Custody, which allows institutional investors to store assets securely off-chain.

Is Binance On-Chain or Off-Chain?

Binance is mainly an off-chain, centralized crypto exchange. Transactions happen within Binance’s internal ledger for faster trades. Deposits and withdrawals occur on-chain, involving respective blockchain networks. Binance also offers Binance Smart Chain (BSC), an on-chain platform for dApps and smart contracts.

Is Tectum On-Chain or Off-Chain?

The Tectum blockchain and its TET token are an on-chain platform. As an on-chain system, it operates directly on a blockchain network, ensuring transparency and security through decentralized processes.

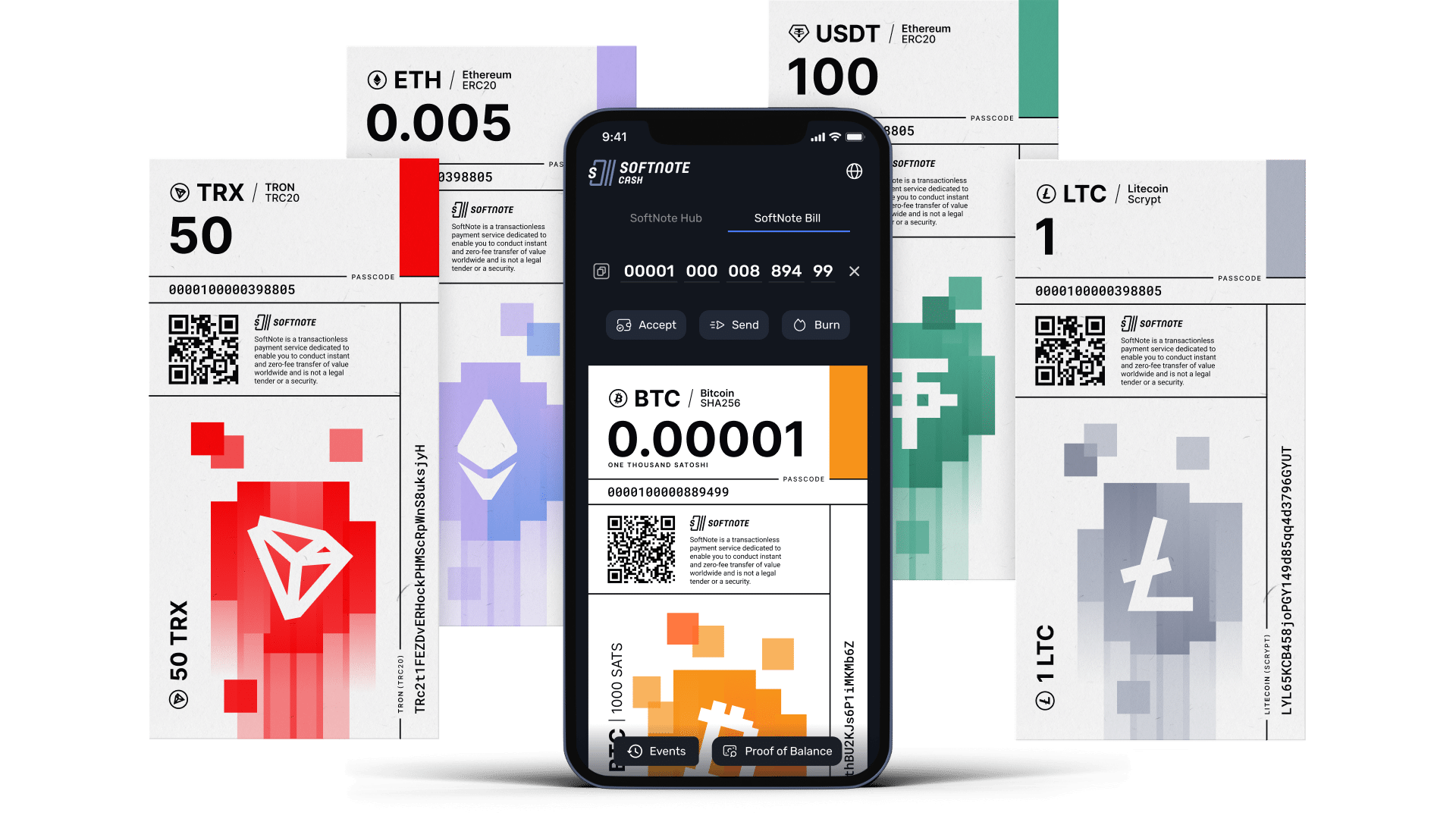

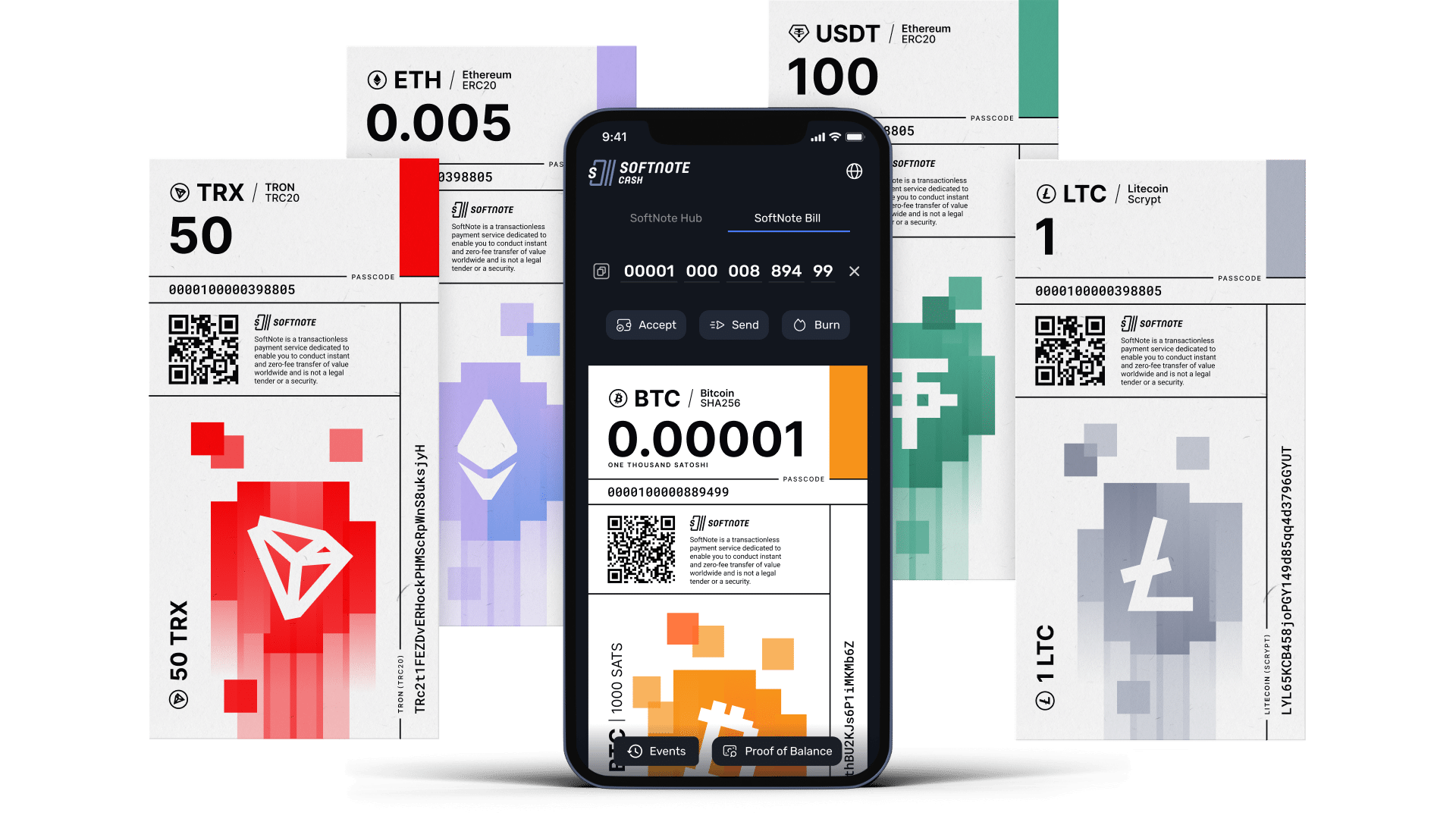

Tectum offers both On-chain and Off-chain solutions with Softnote

Examples of on-chain vs off-chain transactions

Here are some more examples of on-chain vs off-chain transactions:

On-Chain Transactions:

- Processing and recording Bitcoin transactions occur directly on the blockchain.

- Execution and validation of Ethereum or Bitcoin smart contracts take place on the blockchain.

- Bitcoin mining adds new blocks of transactions to the Bitcoin blockchain.

Off-Chain Transactions:

- Lightning Network transactions enable instant, low-cost Bitcoin payments by creating user payment channels.

- Payment processors like Coinbase let users buy and sell cryptocurrencies off-chain before transferring them to on-chain wallets.

- Sidechains, separate blockchains interoperable with the main blockchain, execute transactions faster and more efficiently than on-chain transactions.

Regarding staking, on-chain staking requires locking up a portion of cryptocurrency on the blockchain to validate transactions and earn rewards. Off-chain staking involves staking through a third-party service or platform not directly connected to the blockchain. This provides greater flexibility and can improve the speed and efficiency of staking. However, it introduces additional risks, such as the third-party service being hacked or offline.

Advantages and Disadvantages

On-Chain Advantages:

- Decentralization: On-chain transactions and processes reduce the need for centralized intermediaries by occurring directly on the blockchain.

- Security: Blockchain networks protect data and transactions with strong security measures, such as cryptographic hashing and consensus algorithms.

- Transparency: Public visibility and audibility of all on-chain transactions promote trust and openness.

- Immutability: The unalterable nature of transactions recorded on the blockchain ensures data integrity.

- Smart Contracts: On-chain platforms often support programmable, self-executing smart contracts.

On-Chain Disadvantages:

- Scalability: Increased transaction volumes can cause scaling issues for blockchain networks, leading to slower processing times and higher fees.

- Energy Consumption: Consensus algorithms like Proof of Work require significant energy resources, causing environmental concerns.

- Complexity: Developing and deploying on-chain solutions demand specialized knowledge due to technical complexity.

- Privacy: Limited privacy is a downside of public blockchains, as they have transparent transactions.

Off-Chain Advantages:

- Scalability: Off-chain solutions handle higher transaction volumes and offer faster processing times compared to on-chain systems.

- Lower Costs: Off-chain transactions usually have lower fees than on-chain transactions.

- Privacy: Off-chain solutions offer better privacy since transactions are not publicly recorded on the blockchain.

- Flexibility: Off-chain platforms adapt and update more easily to meet evolving requirements and user needs.

Off-Chain Disadvantages:

- Centralization: Off-chain solutions often involve centralized intermediaries, creating single points of failure and reducing system resilience.

- Security: Off-chain solutions might be more vulnerable to hacking and data breaches, depending on the specific implementation.

- Trust: Users may need to trust off-chain platform operators to manage their funds and data properly.

- Interoperability: Off-chain solutions may face challenges when interacting with on-chain systems or multiple blockchain networks.

How Do Off-Chain Solutions Like the Lightning Network Work to Improve the Scalability of Blockchain?

Off-chain solutions like the Lightning Network allow faster and cheaper transactions by moving them off the blockchain. The Lightning Network is a payment protocol that operates on the Bitcoin blockchain, allowing users to create payment channels that bypass the blockchain. This allows for near-instant transactions and significantly reduces transaction fees.

On-Chain vs Off-Chain Staking

Staking is the process of holding cryptocurrency in a wallet to support the security and operation of a blockchain network. On-chain staking involves holding the cryptocurrency on the blockchain network and participating in the consensus mechanism. Off-chain staking involves holding the cryptocurrency off the blockchain network and participating in staking pools or other off-chain solutions. This staking allows for more flexibility and faster rewards but is typically less secure than on-chain staking.

Off-chain vs on-chain solutions have different benefits and drawbacks, depending on the use case. On-chain transactions are more secure and transparent but are slower and more expensive than off-chain transactions. Off-chain transactions are faster and cheaper but are less secure and transparent than on-chain transactions. Understanding the differences between off-chain vs on-chain solutions is important for developers and users to make informed decisions about the best solutions for their needs.

What are some of the potential security risks associated with using off-chain solutions for blockchain transactions?

While off-chain solutions can offer benefits such as faster transaction times and lower fees, they also come with some potential security risks. Here are a few examples:

- Centralization: Off-chain solutions often rely on a centralized third-party service or platform to facilitate transactions. This creates a single point of failure that could be targeted by attackers or vulnerable to internal fraud.

- Counterparty Risk: With off-chain transactions, there is a counterparty risk that the other party may not fulfill their end of the transaction. This is especially true when using centralized third-party services or platforms that may not be fully regulated or audited.

- Interoperability: Off-chain solutions may not be interoperable with all blockchains, leading to issues if users need to move funds between different networks.

- Privacy: Some off-chain solutions may not offer the same level of privacy and security as on-chain transactions. For example, transaction data could potentially leak from a payment channel if it lacks proper security.

- Upgrades and Maintenance: Off-chain solutions may require frequent upgrades and maintenance to ensure their security, which can be time-consuming and expensive for users.

It’s important for users to carefully evaluate the security risks and benefits of off-chain solutions before using them to conduct transactions on the blockchain. This may involve conducting due diligence on third-party providers and using proper security measures, such as multi-factor authentication and encryption, to protect their assets.