Here’s a simple overview of how cryptocurrency works:

Blockchain Technology

Cryptocurrencies use blockchain technology, a distributed digital ledger that records all transactions across a network of computers. Each block contains a list of transactions, and cryptography links the blocks together, forming a chain.

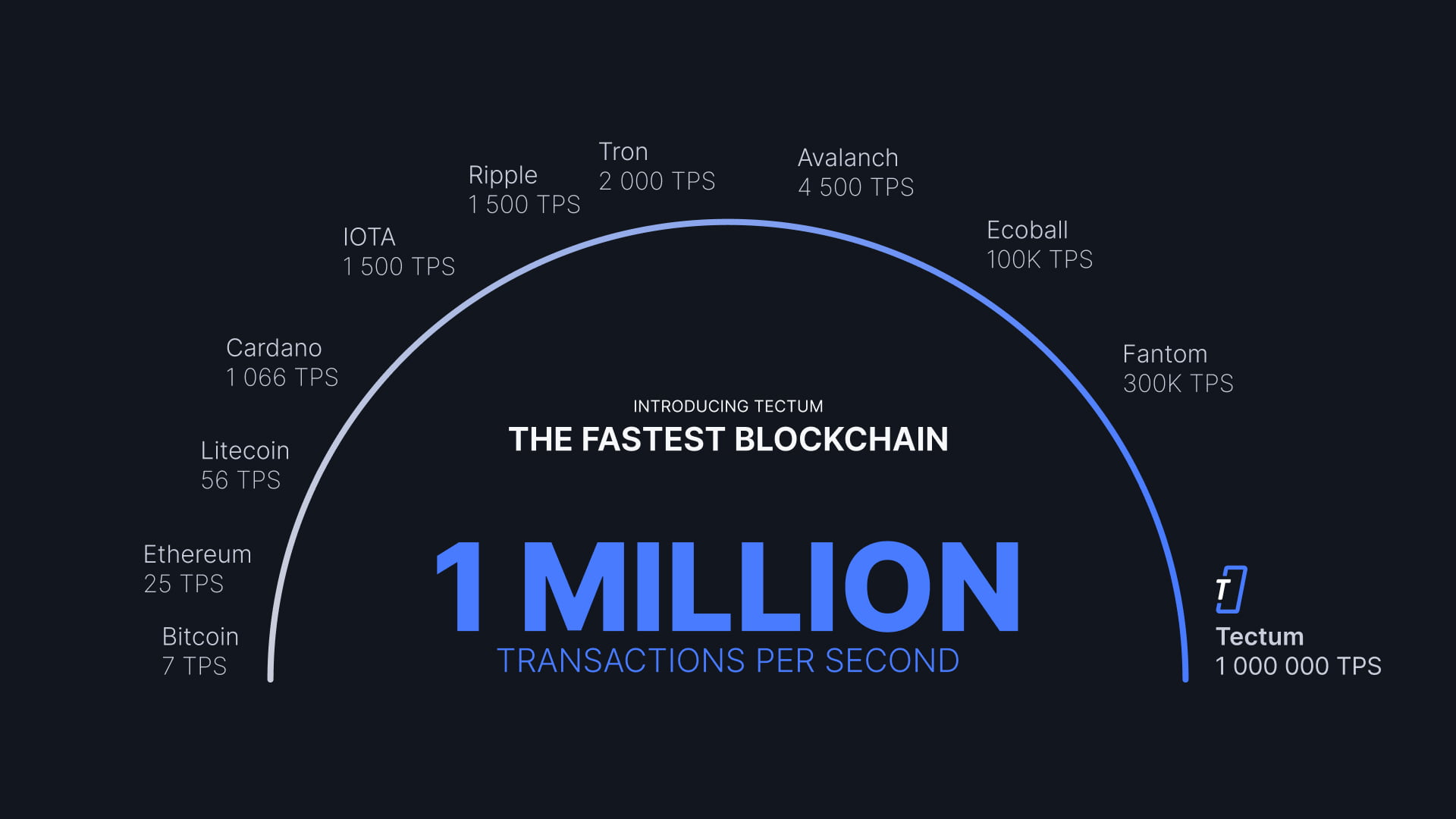

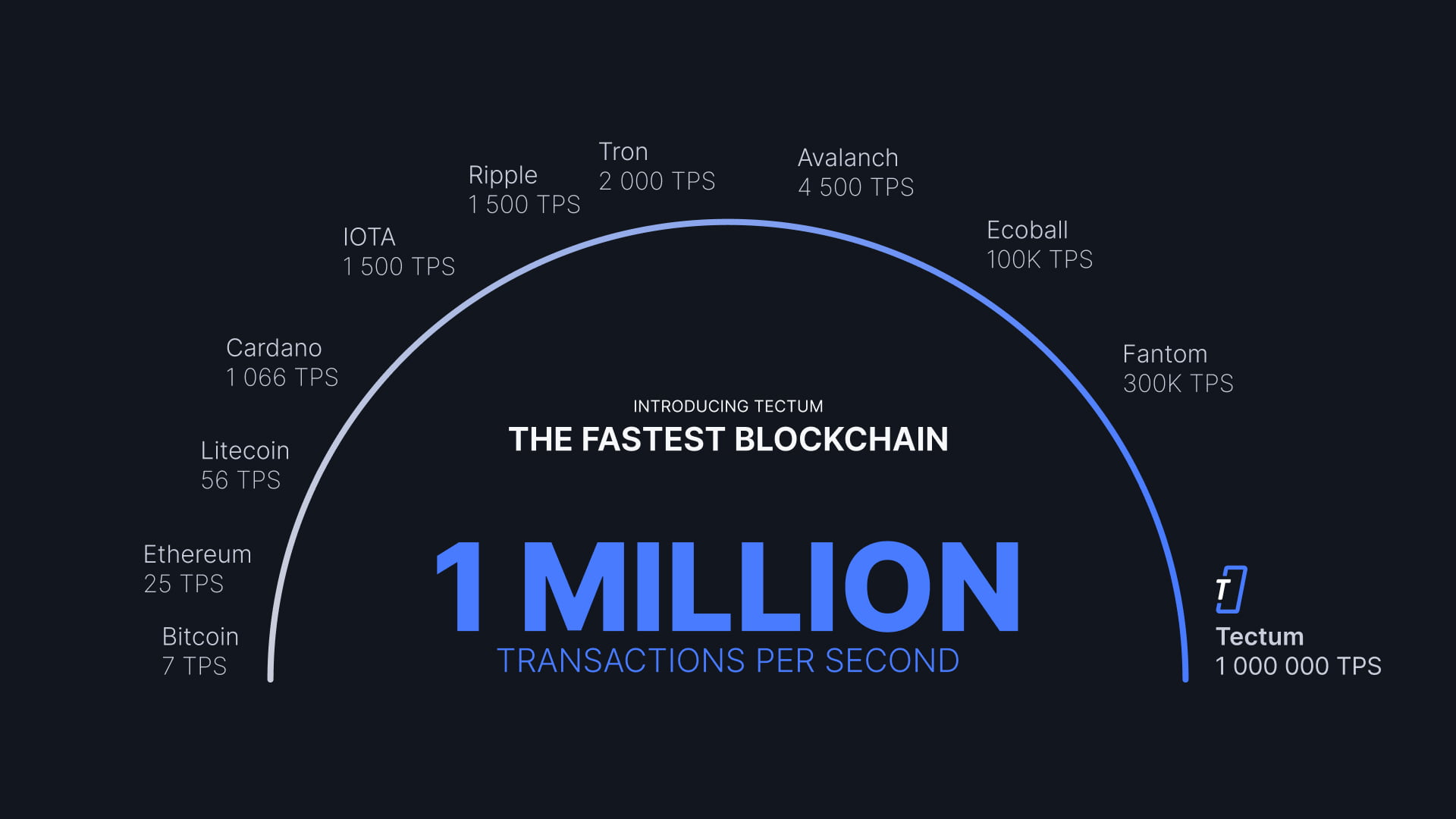

Blockchains can be differentiated by their speed, calculated by the number of Transactions per second (Tnx/sec). Blockchain like Bitcoin and Ethereum process 7 and 25 tps/sec respectively, on the other hand, the Tectum blockchain can process 1 million tps/sec

Decentralization

Cryptocurrencies are decentralized, meaning no single entity controls the network. Instead, the network’s participants make decisions collectively. This is different from traditional currencies, which are controlled by a central authority like a government or a central bank.

Consensus Mechanisms

Various consensus mechanisms maintain the integrity and security of the blockchain. The most common are Proof of Work (PoW) and Proof of Stake (PoS). In PoW, miners use computational power to solve complex mathematical problems to validate transactions and create new blocks. In PoS, validators create new blocks and validate transactions based on their stake (or ownership) of the cryptocurrency.

Transactions

When you want to send cryptocurrency to someone else, you sign the transaction with your private key, a unique and secret piece of information that verifies your ownership of the coins. The network then validates the transaction, and miners or validators add it to the next block.

Mining and Staking

In PoW-based cryptocurrencies like Bitcoin, mining generates new coins. Miners compete to solve complex mathematical problems, and the first one to solve it adds a new block to the blockchain and receives new coins as a reward. In PoS-based cryptocurrencies, staking generates new coins, where participants lock up a certain amount of their coins as a stake and receive new coins based on their stake and other factors.

Wallets

You need a digital wallet to store and manage your cryptocurrencies. Wallets can be software-based (like desktop or mobile applications) or hardware-based (like physical devices). Wallets store your private keys, allowing you to send and receive cryptocurrencies securely.

Exchanges

Cryptocurrency exchanges are platforms that enable you to buy, sell, and trade cryptocurrencies for other digital assets or fiat currencies (like USD, EUR, etc.). Some popular exchanges include Coinbase, Binance, and Kraken.

How Does Cold Storage in Crypto Work?

Cold storage involves keeping the private keys of a cryptocurrency wallet offline, disconnected from the internet, to protect them from unauthorized access, hacking, and other potential risks. It is considered one of the most secure ways to store cryptocurrencies, minimizing the chances of theft or loss due to cyberattacks.

Here’s how cold storage works in crypto:

Generate a Private Key

The first step in cold storage is generating a private key, a unique and secret piece of information that verifies your ownership of the coins. Various methods can be used, such as hardware wallets, paper wallets, or even manually generating a key using dice rolls or coin flips.

Create a Public Address

After generating a private key, you can derive a public address from it. The public address is what you’ll share with others when receiving cryptocurrency transactions. It’s crucial to keep your private key secret since anyone with access to it can control your coins.

Transfer Funds

After generating a private key and its corresponding public address, transfer your cryptocurrency funds to the cold storage wallet by sending a transaction from your

How do Taxes work in crypto?

One of the concerns for crypto investors is the taxation of their assets. Although cryptocurrencies do not fall under central bank regulation, the IRS still taxes them like fiat currency. Cryptocurrencies face various tax levels. Check the IRS website to see what tax obligation you may have.

Other Resources on How Cryptocurrency(ies) Work

For more online resources and information on how cryptocurrency work, especially how the TET token works, Tectum has a number of resources on YouTube.