How Crypto Has Reacted to the US Elections

Trump’s Win at the US Elections Sends Ripple Effects Through the Cryptocurrency Market

Trump’s Win at the US Elections Sends Ripple Effects Through the Cryptocurrency Market

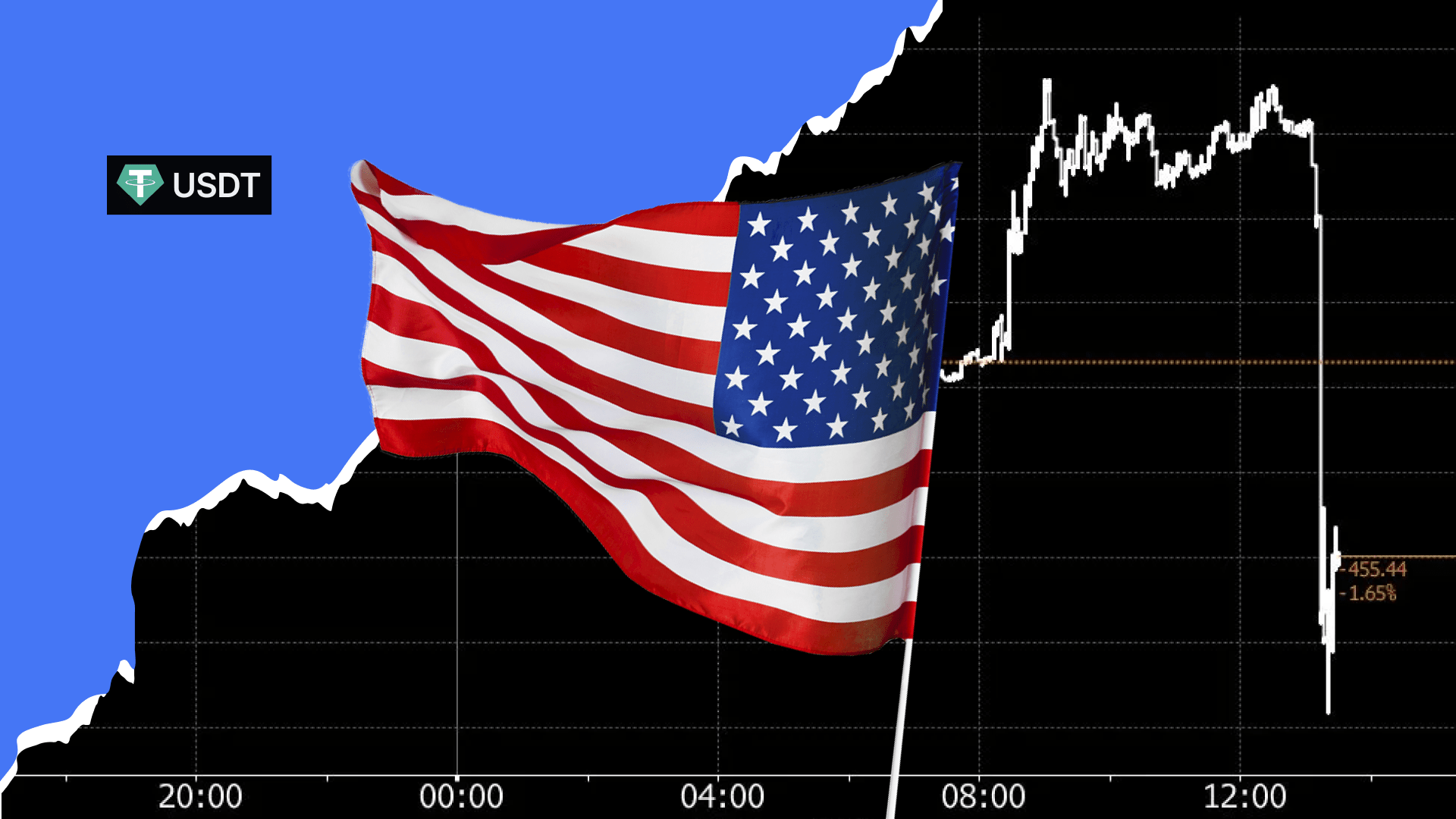

Cryptocurrency markets have seen significant turbulence following the 2024 U.S. presidential election and Donald Trump’s confirmed return to the White House. Within days, major coins like Bitcoin and Ethereum experienced fluctuations as investors speculated on how Trump’s policies may impact the future of digital assets. Early reports from platforms like CoinMarketCap show that Bitcoin initially surged over 3% immediately after election night, reaching the record of 77k USD, only to pull back as regulatory uncertainties became a focal point.

Throughout his campaign, Trump hinted at reducing regulatory oversight to promote financial innovation, aligning with the hopes of crypto advocates such as Elon Musk. His pro-business stance could potentially mean fewer restrictions on digital asset transactions, which has contributed to an optimistic outlook among some investors. However, it remains to be seen whether Trump will continue to favour the largely hands-off approach or introduce specific guidelines around taxation and securities regulation. Many in the industry are watching for new legislative movements or executive orders that could clarify or reshape crypto policies under his administration. Worth noticing that the current state of the US policy on cryptocurrency is either simply unclear or unstated.

The election outcome has not been universally positive across all crypto assets. While Bitcoin and a few others spiked initially, altcoins have seen mixed reactions, likely due to heightened concerns about regulatory focus. Crypto companies and exchanges in the U.S. are particularly sensitive to policies that might redefine their compliance needs, and some analysts argue this concern is already impacting trading volumes across platforms.

Stablecoins such as USDT, which were primarily at the centre of regulatory discussions during the Biden administration, may face a more uncertain path under Trump. His administration might deprioritise the development of a U.S. Central Bank Digital Currency (CBDC), which could shift the competitive landscape of stablecoin providers globally.

The days following the election have seen both cautious optimism and market volatility as the crypto industry waits for Trump’s policy direction. Although his victory has spurred interest, the real impact on the cryptocurrency landscape will unfold in the coming months. Given the potential for a friendlier stance on digital currencies, the crypto community remains on alert for further shifts as Trump takes office, possibly setting the stage for either a new boom or a recalibration of expectations across the market.