Benefits of Instant Payments

Instant payments in the global financial market will significantly enhance the speed of transactions. Whereas it currently takes up to one business day for a payment to reach its beneficiary, instant payments will make funds available to recipients immediately, 24/7/365.

Other benefits include:

- Enhanced transaction speed: Instant payments significantly reduce the time it takes for funds to reach the beneficiary, making funds available almost immediately.

- Improved convenience: Users can make instant payments anytime, anywhere, providing a more accessible and convenient method of transferring money.

- Time-sensitive payments: Instant payments enable users to make time-critical transactions, ensuring that payments are made when they are most needed.

- Increased financial inclusion: Instant payment solutions can help promote financial inclusion by making digital payments more accessible to those without traditional banking services.

- Support for person-to-person mobile payments: Instant payments can facilitate the development and adoption of person-to-person mobile payment services, allowing individuals to easily send and receive funds.

- Cost efficiency: In some cases, instant payments can reduce transaction costs for both consumers and businesses, making it more affordable to send and receive money.

- Improved cash flow management: Instant payments can help businesses and individuals better manage their cash flow by ensuring quicker access to funds.

- Enhanced security: Many instant payment solutions are designed with robust security features to protect users from fraud and unauthorized transactions.

- Opportunities for value-added services: Instant payments can serve as a foundation for the development of new financial products and services, such as real-time invoice payments or automated recurring payments.

- Greater trust in digital payments: Instant settlements can increase user confidence in digital payment systems, encouraging further adoption and use of these services.

Global Initiatives for Instant Payment Solutions

Various countries worldwide have implemented or are developing instant payment solutions, driven by central banks, industries, or collaborative efforts. The challenge for global financial market integration is ensuring that the introduction of instant payment services and innovative retail payment solutions does not reintroduce fragmentation in the global retail payments market.

Addressing Fragmentation and Interoperability

The risk of fragmentation arises from the development of national, proprietary, or closed-loop solutions lacking interoperability. To mitigate this risk, financial authorities and industry stakeholders are working together to develop and promote interoperable instant payment schemes.

Crypto Payment Solutions: Encouraging Global Adoption

The rise of cryptocurrencies has brought forth a new era in digital payments, offering potential benefits such as decentralization, reduced transaction costs, and faster settlement times. However, for cryptocurrencies to become mainstream and achieve widespread adoption, several factors need to be addressed. This is where SoftNote comes in.

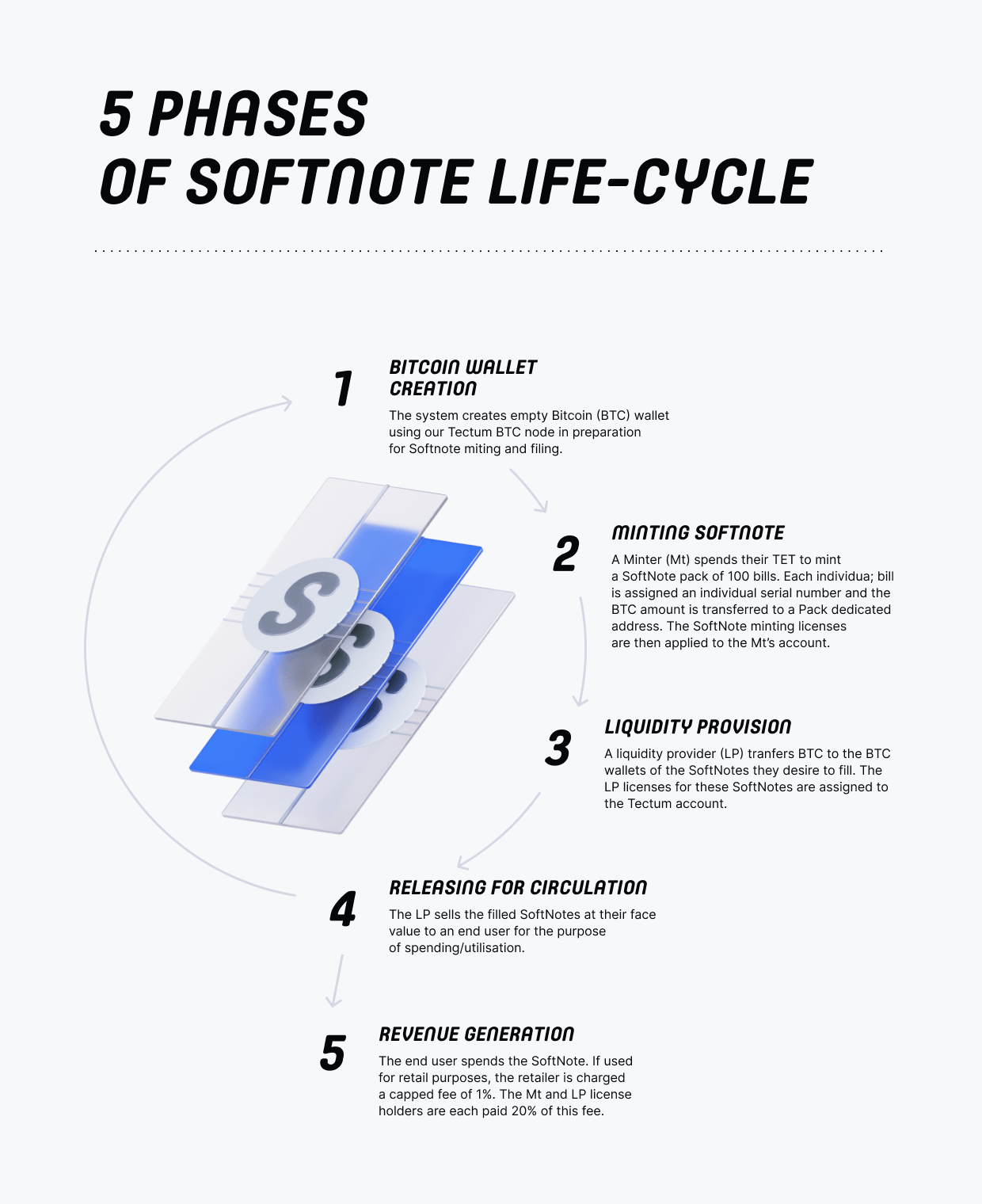

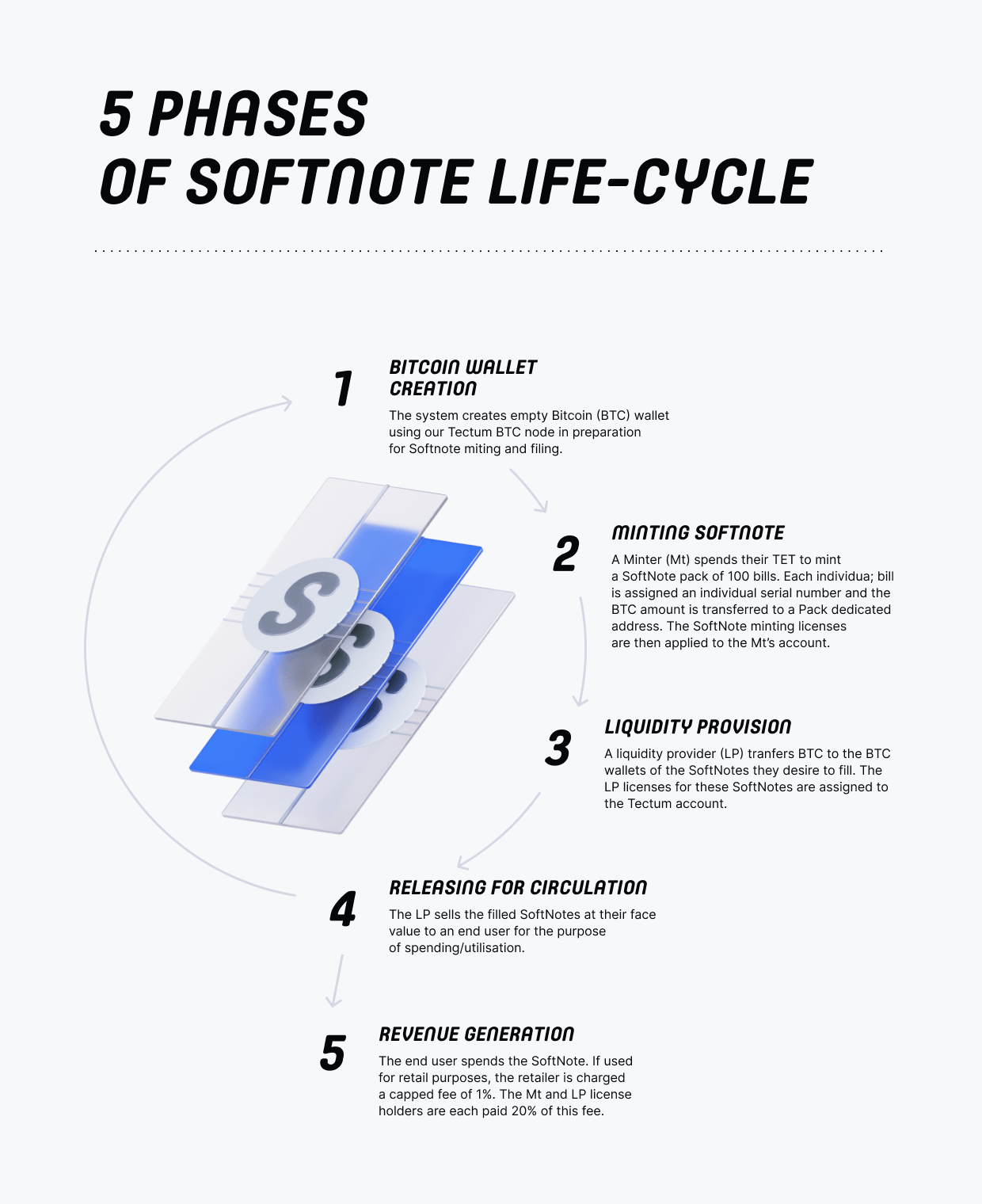

SoftNote: The Solution for Micropayments and Instant Settlements

SoftNote is an interesting and relevant topic in the context of the ongoing digital transformation of finance and the increasing demand for more efficient payment solutions.

Micropayments, which involve small transactions typically less than a dollar or 1BTC, have been a challenge for traditional payment systems and emerging cryptosystems due to high transaction costs and slow processing times.

A solution like SoftNote could potentially address these challenges and offer several benefits:

- Increased efficiency: SoftNote could provide a more efficient way to process small transactions by reducing processing times and transaction fees, making it more feasible for businesses and individuals to engage in micropayments.

- Financial inclusion: With the ability to handle micropayments, SoftNote could help in promoting financial inclusion by enabling access to digital payments for individuals who may not have access to traditional banking services or who find it difficult to afford high transaction fees.

- Instant settlements: Instant settlements are crucial for improving the user experience and fostering trust in digital payment systems. SoftNote’s ability to deliver instant settlements could significantly improve the overall experience of using digital payments and increase adoption rates.

- Scalability: A micropayment solution like SoftNote must be capable of handling a large volume of transactions. If SoftNote is designed to be scalable, it could potentially support a wide range of applications, including online content monetization, in-app purchases, and pay-per-use services.

- Enhanced security: SoftNote’s success will also depend on its ability to provide a secure environment for transactions. Ensuring privacy, data protection, and fraud prevention will be essential to gain users’ trust and fostering widespread adoption.

SoftNote: Crypto Payment Solutions Supporting Instant Payments in the Global Market

The successful rollout of instant payments relies on both payment service providers and the availability of a secure, efficient market infrastructure capable of processing instant payments across the world. By offering SoftNote, the global financial system ensures that the demand for instant payments is met on an international level, further promoting integration in the global market.

SoftNote, an innovative solution, has addressed the key challenges hindering the global adoption of cryptocurrencies, making it a game-changer in the digital payments landscape.

Enhancing Accessibility and Usability

SoftNote has made cryptocurrencies easily accessible and user-friendly by developing an intuitive and secure digital wallet, an active community, and seamless integration with existing financial systems. By offering educational resources and improving overall user experience, SoftNote has demystified cryptocurrencies and promoted adoption among individuals who may be unfamiliar with the technology.

Regulatory Clarity and Collaboration

SoftNote has worked closely with governments and regulatory bodies to foster confidence and ensure long-term stability. By collaborating with industry stakeholders, SoftNote has contributed to the development of clear and fair regulations that promote innovation while safeguarding users’ interests. These clear regulations have helped to legitimize cryptocurrencies and attract businesses, investors, and users to adopt them as a viable payment option.

Interoperability and Standardization

To promote global adoption, SoftNote has ensured interoperability and standardization among various cryptocurrencies and blockchain networks. By developing standardized protocols and fostering cross-chain communication, SoftNote has streamlined transactions, improved efficiency, and enhanced the overall user experience. Interoperability has also contributed to reducing market fragmentation and increasing the potential for collaboration among different blockchain projects.

Scalability and Performance

SoftNote has addressed the scalability and performance challenges by implementing advanced technologies capable of handling a large volume of transactions without compromising speed and performance. Ongoing research and development in areas like layer 2 solutions, sharding, and other scaling techniques have allowed SoftNote to improve transaction throughput and address the issue of network congestion.

Security and Privacy

SoftNote has prioritized security and privacy, implementing robust security measures to protect against hacks, fraud, and unauthorized transactions. By incorporating privacy-enhancing technologies, such as zero-knowledge proofs and confidential transactions, SoftNote has fostered trust and safeguarded users’ sensitive information.

By addressing these factors and working together with regulatory authorities, industry stakeholders, and the broader community, SoftNote has accelerated the global adoption of cryptocurrencies, ultimately transforming the landscape of digital payments and the global financial system.

Conclusion

Overall, SoftNote’s crypto payment solutions appear to be a promising topic in the evolving landscape of digital finance. It could offer a practical solution to the challenges associated with micropayments and help drive the adoption of digital payments globally.

For online resources and information on how cryptocurrency work, especially how the TET token works, Tectum has a number of resources on YouTube. On the Tectum YouTube channel, your questions will be answered, and you will get concise information about the efficiencies of the Tectum blockchain, and future airdrops coming on the TET tokens.