First, we need to understand the main idea behind its invention before answering the question; what is the lightning network? The lightning network was primarily introduced to push well beyond the speed limit of bitcoin. The main concept behind it is the storage of small-scale, daily transactions away from the main blockchain. This idea is called the off-chain approach. Let’s dive further into more details about this innovative network.

Who Invented the Lightning Network?

Although the concept of payment channels dates back to the creation of Bitcoin itself, the Lightning Network officially came to life in 2015. The research paper titled “The Bitcoin Lightning Network” by Joseph Poon and Thaddeus Dryja was the first mention of the network. This paper was based on the documented conversations between Mike Hearn and the unknown founder of the Bitcoin network, Satoshi Nakamoto on payment channels in 2013.

Poon and Dryja’s paper touches on the subject of an off-chain approach to the network protocol with the use of payment channels. It also highlights the slow pace of the bitcoin network and how scalability is bound to be an issue in the future. It then proposes the Lightning Network’s off-chain payment channels as the solution to the problem of scalability in the blockchain.

The network is not owned or controlled by any organization or person. The company developing the network is called Lightning Labs. The project has an open-source code and virtually anyone can run a node and join the network.

What is Lightning Network in Blockchain?

Bitcoin wasn’t designed to handle the volume of transactions that now take place on the network protocol. The Lightning Network utilizes payment channels between trading parties to allow for multiple without waiting for the original network to validate each exchange. That way, the network is not congested and participants can exchange funds for as long as the channel is kept open by both parties. After it’s closed, the channel and all its transactions are approved by the main network.

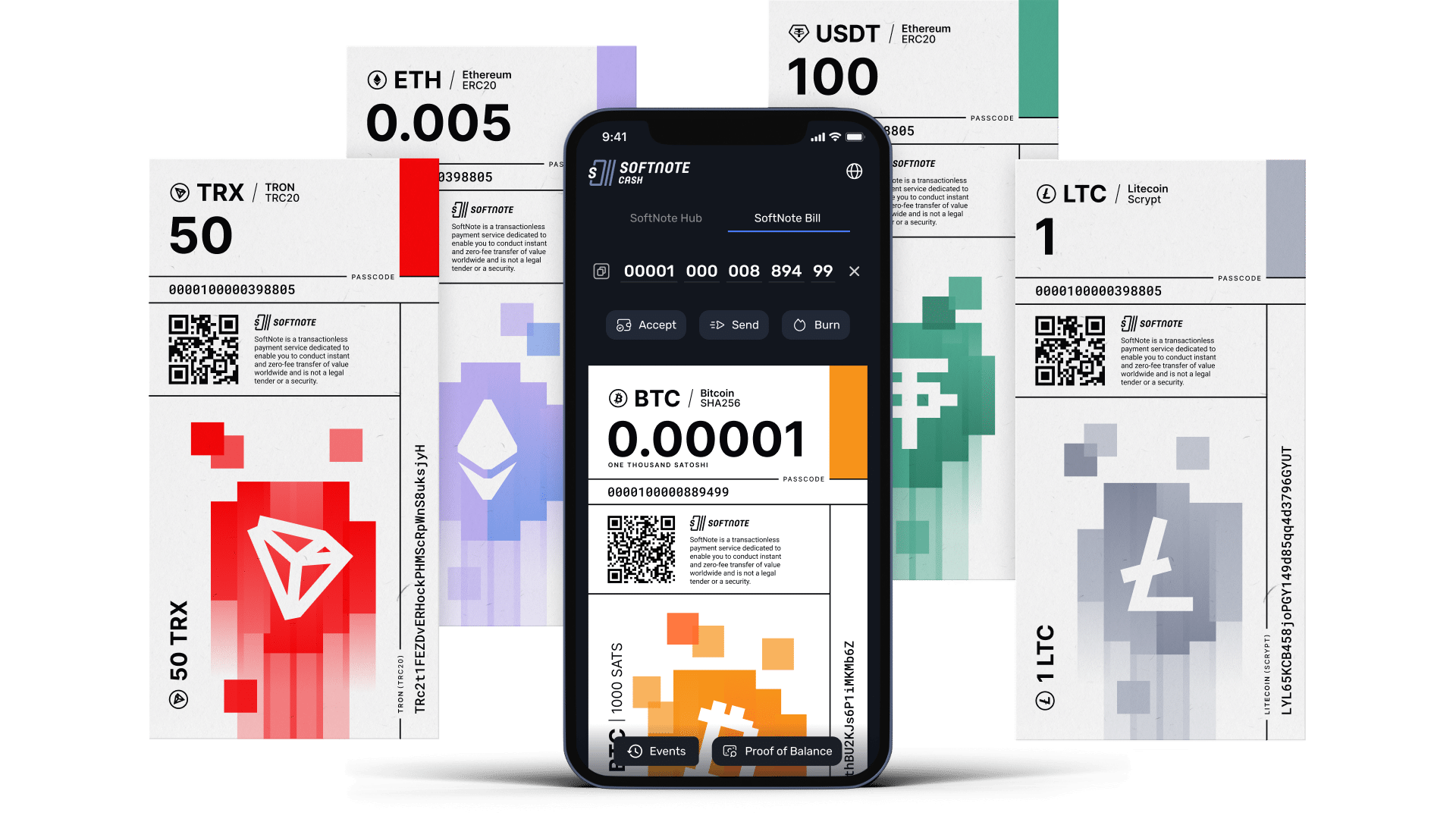

Tectum’s Softnotes uses the lightning network technology

What is Lightning Network and how does it work?

The lightning network is a 2nd layer payment protocol that operates on bitcoin and other cryptocurrencies’ blockchains. It is characterized by a peer-to-peer system for processing micropayments of coins via a network of two-way payment channels.

In layman’s terms, the lightning network allows systems to conduct faster and cheaper blockchain transactions by focusing their storage on relevant data which is about their own money. The network’s crypto protocol was designed to scale and speed up transactions on all kinds of blockchains. Although it can be operated on any blockchain, it was mainly created to resolve some of the issues facing the Bitcoin blockchain.

Since the distribution of Bitcoin has the problem of scalability, the new network was designed to make that a thing of the past. Another concern that this innovative network solves is Bitcoin’s block confirmation period (the period for confirming BTC transactions), which can extend up to 10 minutes.

Besides, small payments are not feasible on the blockchain because of the relatively high cost of each bitcoin transaction. In comparison to BTC, the lightning network can carry out transactions almost instantly with its transaction costing as little as a fraction of a cent or even zero.

The Technology Behind the Network

The fundamental technology behind the Lightning Network is known as payment channels. In practice, a bidirectional lightning payment channel is opened when the two sides of a deal agreed to a multi-signature deal. Furthermore, the multi-signature transaction must be funded by one or both of the parties. The committed funds are input into a ledger entry that mandates two out of two signatures to be accessed, with each party holding a private key into the ledger entry.

The first transaction which creates the payment channel will require the regular block time (about 10 minutes). Consequently, both parties of the transaction can deal instantly with funds in the channel deposited by at least one of the parties. Approved transactions are sent back and forth while spending funds from the ledger, to authenticate these instantaneous deals.

Normally, the validity of these transactions would depend on whether miners included them in the blockchain network. However, the approved deals in a lightning network payment channel will only get broadcast after the channel is terminated by both parties. Approved deals that are not broadcast are traded with a direct peer-to-peer network and they serve as invoices for each participant to hold on to and possibly redeem sometime in the future.

Can you Invest in the Lightning Network?

Technically, you can’t invest in the Lightning Network directly because there’s no such thing as a lightning network token. The network operates with BTC, so you’ll not have to trade with any form of coin in the payment channels. Nevertheless, private investors can invest in the organization that develops the network like Lightning Labs.

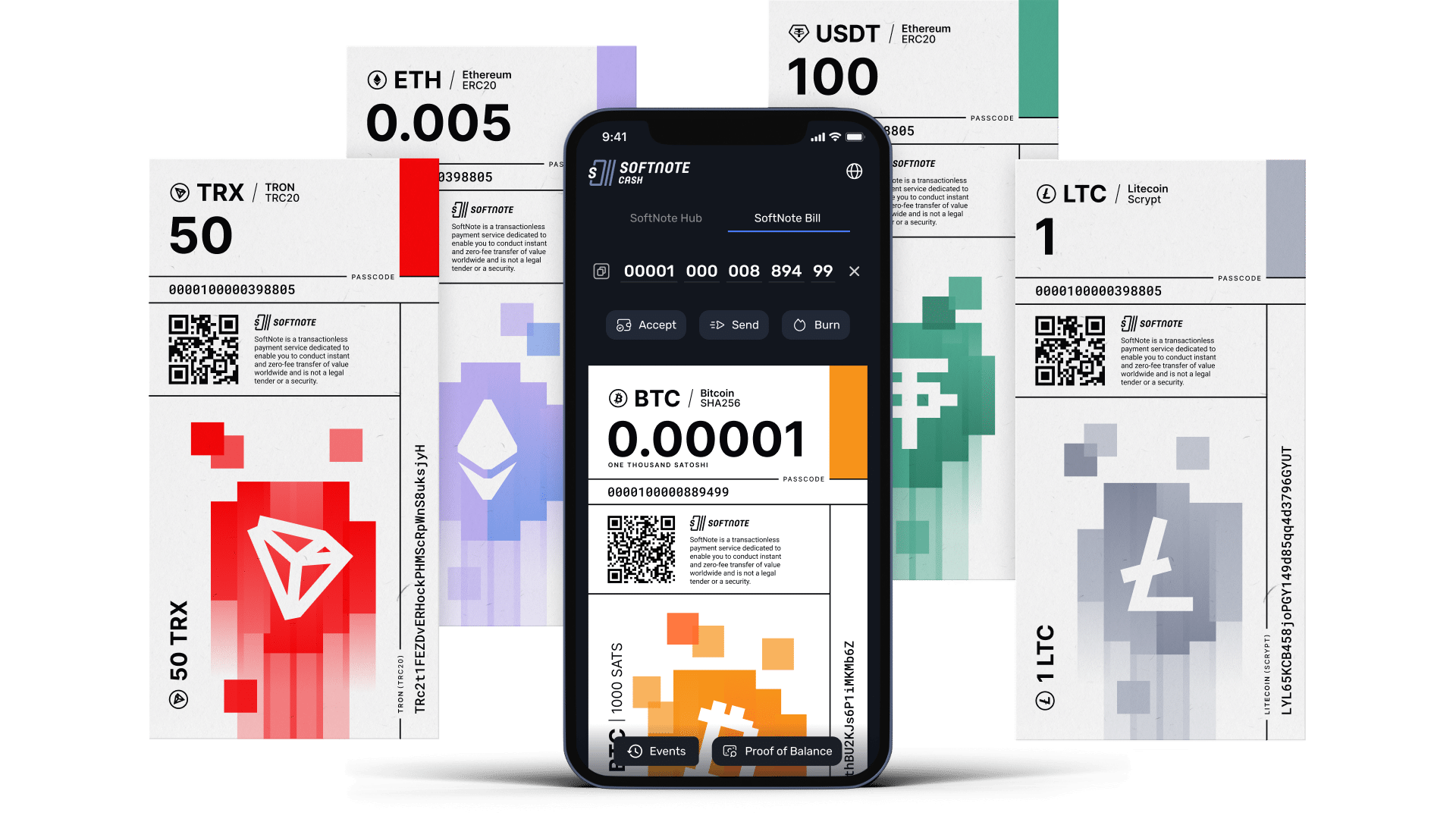

Tectum’s Softnote lightning network speeds

Will the Lightning Network Transform Bitcoin?

Yes, the lightning network promises to evolve the blockchain and other cryptocurrencies. However, there are some concerns that the network brings to mind such as its exposure to closed channel fraud where one of the trading parties has malicious intent to steal the funds. It’s for this reason that nodes called watchtowers are typically conducted by third parties to prevent fraudulent termination of channels in the network.

Many of these third-party applications incur charges and trading parties may have to meet up with new fees as more businesses utilize the network as settlement and payment layers. Besides that, the payments are vulnerable to hacks alongside the APIs (application programming interfaces) and wallets. Furthermore, congestion during malicious attacks can deny participants from removing their coins from the lightning network channel the instant the attack is noticed. The congestion can also be induced by the attack to prevent the cash out of tokens.

There’s still so much for the network to resolve before it can be considered the new face of bitcoin, but it sure has a promising future in the crypto industry. To prove this you can check out our Tectum BTC Softnotes.

*If you have any further questions about the issues raised in this article or any further concerns, you have, please do not hesitate to contact Tectum at support@tectum.io or follow us for more on our social channels.